- Rich Gribbon

- Jul 30, 2025

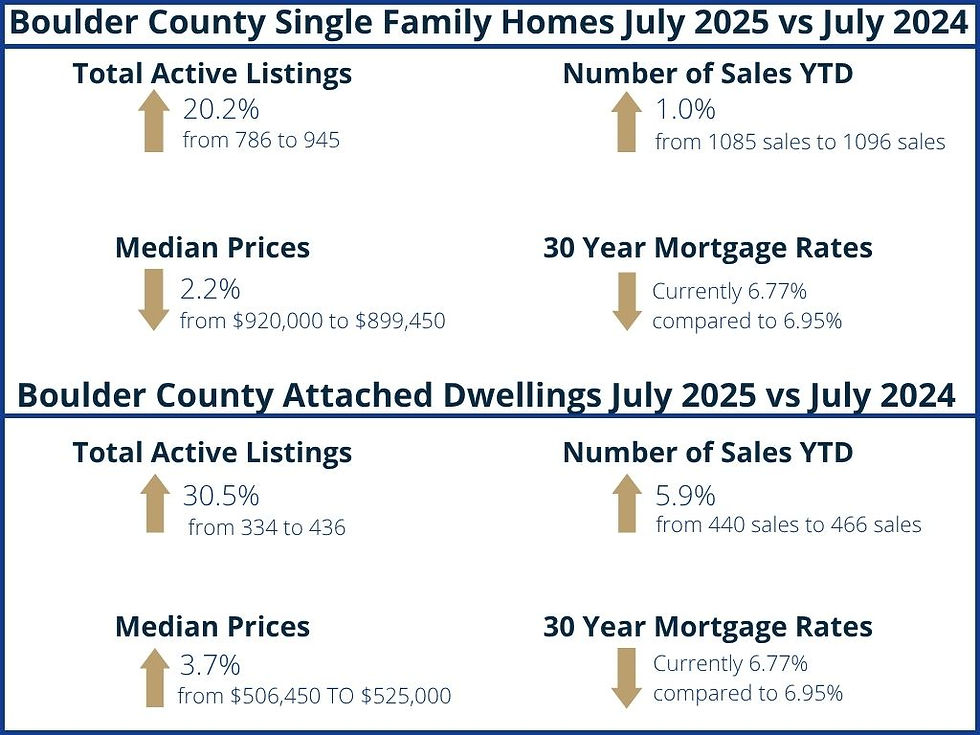

Last month I broke down the mid-year stats with a lot of detail. With many of you taking a summer vacation and trying not to pay too much attention to the day to day, I'm providing a graph which captures the stats in the form of a quick summer read - the number of active listings are up substantially, the number of sales have increased slightly and prices are basically flat. Regardless of whether you are on vacation or staying close to home, I hope you are having a great summer. Please reach out if you want to discuss the current market and how I can help make it work for you, whether you are buying, selling or both.

All the best,

Rich